Do you have a question? Want to learn more about our products and solutions, the latest career opportunities, or our events? We're here to help. Get in touch with us.

Do you have a question? Want to learn more about our products and solutions, the latest career opportunities, or our events? We're here to help. Get in touch with us.

We've received your message. One of our experts will be in touch with you soon.

The COVID-19 pandemic has no doubt caused significant disruption and organisational change for many employers. However, it cannot be used as a reason for circumventing normal employment law obligations that continue to apply, regardless of the circumstances we find ourselves in.

A recent decision by the Employment Court of New Zealand in Leota v Parcel Express Limited [2020] NZEmp 61 brings home the importance of reviewing the employment status and the written contracts of independent contractors.

Currently, there are only two categories of workers in New Zealand: employees and independentcontractors. Employees are afforded special employment statutory rights and protections such as minimum wage, leave entitlements and the right to raise a personal grievance under the Employment Relations Act 2000 (ERA). In contrast, independent contractors are deemed to be in business on their own account – ‘an entrepreneur’ – and don’t enjoy the statutory rights and protections afforded to employees.

The Leota v Parcel Express Limited [2020] case concerned a courier driver (Mr Leota) who signed an independent contractor agreement with the company, Parcel Express Limited. Following a series of payment issues, Mr Leota sought a declaration from the Court that he was an employee of Parcel Express Limited. If successful, Mr Leota would be able to retrospectively apply for the statutory benefits that go with being an employee.

Section 6 of the ERA requires a Court to determine the “real nature of the relationship” between the parties, not just the label the parties are calling it.

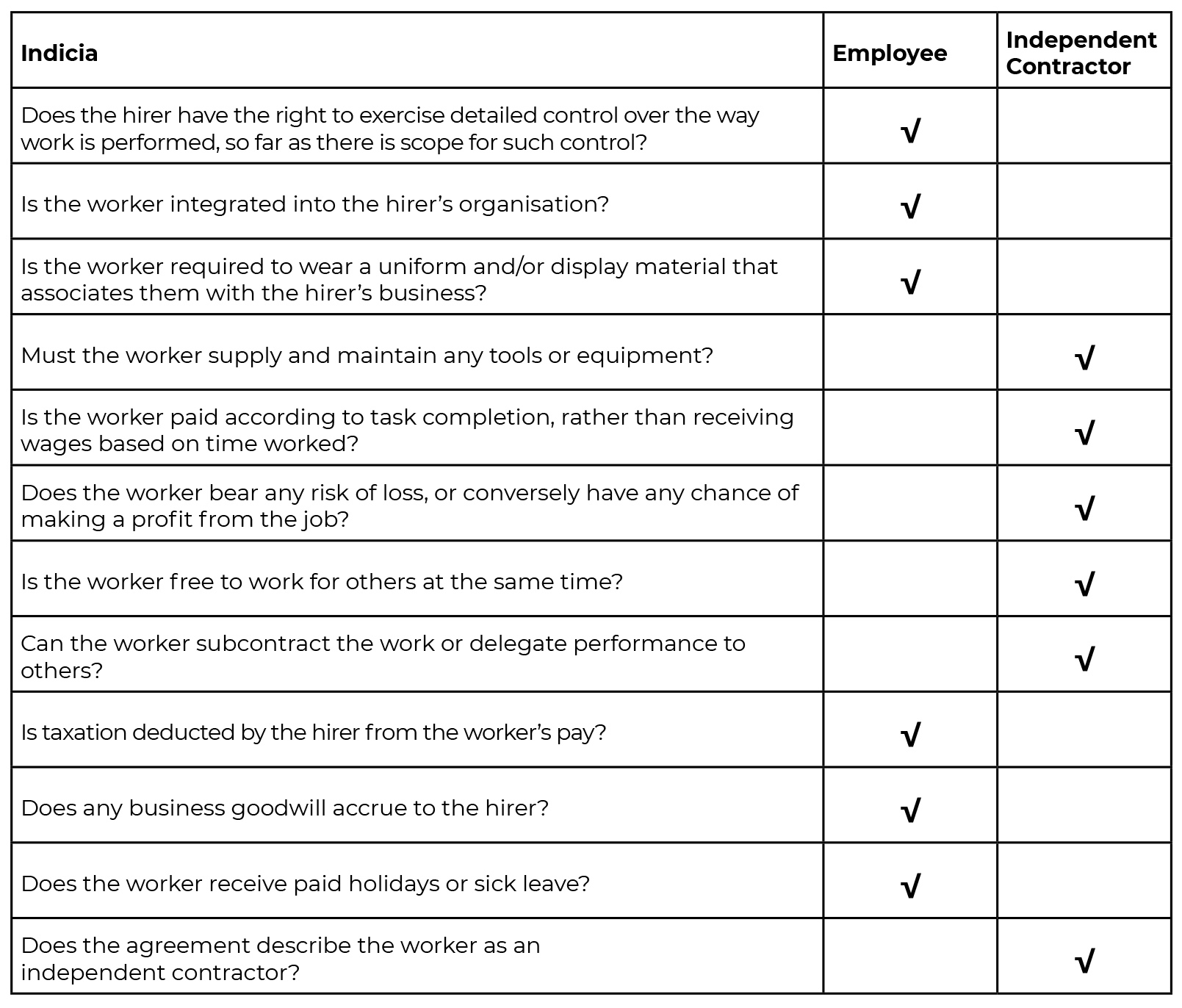

The Court applied well-established legal tests to assist in its assessment of Mr Leota’s status. It also helpfully provided a summary of the key indicators that might signal an employment or independent contractor status:

Reference: Employment Court of New Zealand

The high level of control that was exerted by Parcel Express Limited over Mr. Leota’s work was noteworthy. Some of the factors that supported the decision that Mr. Leota was indeed an employee included:

Ultimately, the Court held that despite Mr. Leota’s agreement stating that his relationship with the Parcel Express Limited was that of an independent contracting party, the “real nature of the relationship” was one of employment.

Although the Court stressed that its decision was limited to the particular facts of the case, there are potentially wider implications for owner/driver operators in the courier industry.

The decision provides a timely reminder for businesses that involve owner/operator drivers to review their practices and ensure the day-to-day working relationship is genuinely one of principal/contractor. Be aware of the risk that the real nature of the relationship can evolve over time into what is in effect an employment relationship.

If a business was to get this wrong, the legal and financial consequences can be significant. Miscategorised employees like Mr. Leota will become entitled to payment for holiday pay and lost wages (e.g. if their remuneration falls below the requirements of the Minimum Wage Act 1983), while also having access to the personal grievance regime provided under the ERA. These are consequences that most businesses, particularly in the current climate, will find difficult to bear.

Disclaimer: The content of this article is general in nature. It is not intended as a substitute for specific professional advice on any matter and should not be relied upon for that purpose.

Visit our payroll systems and human resources solutions pages to read more resources or download here.